Welcome to this August newsletter from the Customer Union for Ethical Banking, the independent union for customers of The Co-operative Bank

In this newsletter: The Co-op campaigns on the Renters Reform Bill; takeovers and speculation; your thoughts on the Farage/Coutts affair; and a new media scandal in the making.

We hope you’ve enjoyed your summer, wet and cold as it was much of the time. Sometimes August is a quiet time for us, but not this year! We have a lot to tell you about. We’re also working away in the background on how to establish a fund to buy shares in the bank: watch this space for news on that.

Co-op Bank supports the Renters Reform Bill

We’ve been pleased to see the Co-op Bank speak out in favour of protection for renters and an end to no-fault evictions in recent weeks. In July the bank joined Shelter in covering Parliament Square in Westminster with 172 moving boxes to represent the number of families facing eviction each day.

The bank is supporting Shelter’s campaign for a strong Renters Reform Bill to end unfair evictions and create a national landlord register. The Co-op Bank, which back in 2006 successfully campaigned for the UK to adopt the Climate Change Act, is also supporting the Zero Hour campaign for a Climate & Ecology Bill. You can sign Shelter’s petition here.

One takeover and one rumour

After months of wrangling, the Co-op Bank has completed the purchase of Sainsburys’ Bank’s mortgage book, for £464 million. As Nick Slape, the bank’s Chief Exec, noted, this is the bank’s first portfolio acquisition in more than a decade.

After months of wrangling, the Co-op Bank has completed the purchase of Sainsburys’ Bank’s mortgage book, for £464 million. As Nick Slape, the bank’s Chief Exec, noted, this is the bank’s first portfolio acquisition in more than a decade.

The bank itself is also subject of sale rumours once again, as Sky News reported at the start of August that Shawbrook, a bank that is around half the size of the Co-op by asset value, has made a bid to buy it. Little has been reported since then, and Sky’s source is reported as saying that “the indicative offer was unlikely to lead to further talks ahead of a wider auction.” We’ll bring more news on this if it comes to anything.

New online platform leads to teething problems; lower call waiting times

We’ve had several members and supporters contact us about the bank’s new online banking platform. On the one hand, some have encountered problems, including around access to PDF statements. We’re communicating these to the bank. On the other, we are hearing from you that the bank’s call waiting times have improved dramatically. We think the new platform looks like a big improvement, and we hope any teething trouble is quickly resolved.

We’ve had several members and supporters contact us about the bank’s new online banking platform. On the one hand, some have encountered problems, including around access to PDF statements. We’re communicating these to the bank. On the other, we are hearing from you that the bank’s call waiting times have improved dramatically. We think the new platform looks like a big improvement, and we hope any teething trouble is quickly resolved.

Your responses on the Farage/Coutts affair

Last month’s newsletter led to more responses from you all than usual. Most were supportive, but a lot of people felt we were too dismissive about Nigel Farage being “debanked” by Coutts, and about the wider problems of “debanking”.

We should have been clearer that we don’t think banks should be denying people an account because of their political beliefs. We’ve also spoken out against the Co-op “debanking” people in the past, when it has been out of line with their ethical policy. The Co-op Bank closed the accounts of a host of civil society groups back in 2015, including the Palestine Solidarity Campaign and many others, we campaigned for the bank to change course. The Telegraph and the Express were notably not interested in taking up their cause at the time.

We commented on the Coutts story because it’s the highest-profile example so far of a drum-beat from some politicians and parts of the media and about “woke banks”, in which the principles of ethical banking are coming under increasingly frequent attack. We need to be ready for this.

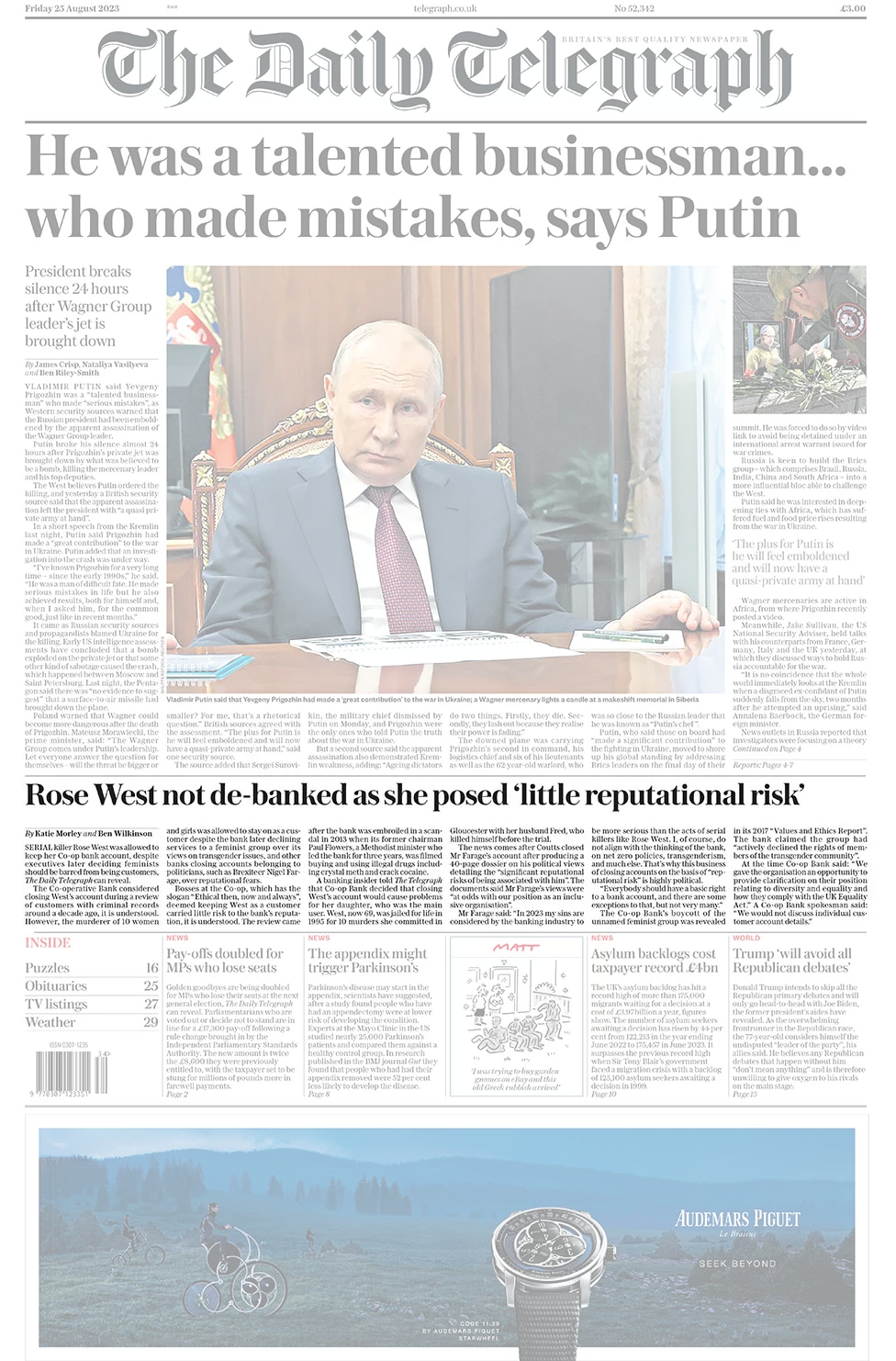

Telegraph story

As we were writing this on Thursday, The Telegraph ran a story that nine years ago the Co-op Bank decided to let the serial killer Rose West keep her bank account, as “closing it would cause problems for her daughter”. The paper contrasted this with the Co-op “declining services to a feminist group over its views on transgender issues” in 2017.

The Telegraph’s story included a comment by Nigel Farage: “In 2023 my sins are considered by the banking industry to be more serious than the acts of serial killers like Rose West.”

The Telegraph’s story included a comment by Nigel Farage: “In 2023 my sins are considered by the banking industry to be more serious than the acts of serial killers like Rose West.”

The story was then picked up by other papers on Friday and Saturday, including the Times, Daily Mail, Express, Guardian and Independent.

As a Customer Union of ethically-motivated Co-op Bank customers, our main concern is that the Co-op Bank acts in line with its Ethical Policy, and nothing in the recent media reports leads us to be concerned on this point.

On the first decision, relating to the serial killer Rose West, everyone has a legally protected right to a basic bank account. There is a discussion to be had about appropriate exceptions for this, which this news story may kick-start, but in this case the bank's main concern seems to have been safeguarding the daughter as the main account user. It’s also worth emphasising that the Co-op's Ethical Policy does not extend to individuals, but rather to businesses and organisations.

Regarding the second decision, the bank said that it had declined a “feminist group that actively denied the rights of members of the transgender community … in breach of our position on human rights, equality, and our diversity and inclusion policies”. As we said in 2018, we were pleased to see the bank defending the rights of transgender people, although we would have liked to have seen more details about the decision and the rationale behind it.

This story may well disappear in the coming days. However, to us it does seem to fit the pattern of a manufactured attack on ethical banking, and we are concerned by this.

We'd be interested to hear members' and supporters’ views.

That’s all for this month,

With best wishes,

Save Our Bank

Have you joined the Customer Union yet? It costs £15 a year to be a member of the first ever customer union co-operative, and help us ensure the Co-op Bank sticks to its principles. It only takes a few moments to sign up here.

info@saveourbank.coop

info@saveourbank.coop @SaveOurBank

@SaveOurBank @saveourbank

@saveourbank