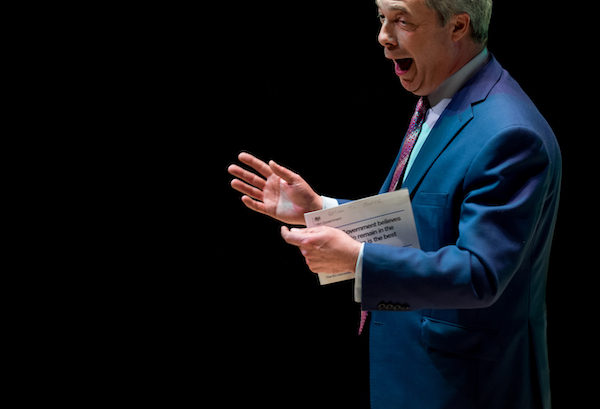

Nigel Farage giving a speech when leader of the Brexit Party. (Photo 155844017 © Kubajunek | Dreamstime.com)

Nigel Farage giving a speech when leader of the Brexit Party. (Photo 155844017 © Kubajunek | Dreamstime.com)The decision of Coutts, a private bank for the wealthy elite owned by NatWest, to close the accounts of supposed anti-elitist Nigel Farage, seems to have played out better for the notorious loudmouth and alleged former National Front supporter (Mr Farage denies this) than it has for the bank, which ended up apologising.

And this was not the month’s only story where bank account closure decisions got wrapped up in the “culture wars”. Earlier in the month, it was reported that the Ministry of Defence would investigate banks for closing the accounts of arms companies. “WOKE BANKS ‘A RISK TO NATIONAL SECURITY’”, was the typically understated front-page take from the Daily Express.

The Co-op Bank, which has made a virtue of denying banking services to businesses and organisations for ethical reasons for the last 25 years, has so far stayed quiet. Should the bank be worried by this furore over banking ethics, or should it be going on the front foot to defend its approach?

In the wake of the massive and disproportionate media storm around Coutts’ decision, new rules intended to clamp down on account closures have been introduced. The legislation requires banks to give clients 90 days’ notice if their accounts will be closed, rather than 30, and to explain their reasons where possible. Fortunately, these rules should not stop the Co-op Bank’s ability to implement its ethical policy, although the bank would have to follow the new rules and give existing customers more time and clarity when accounts are closed for ethical reasons.

Make no mistake, these scandals are right on the Co-op Bank’s turf. While the Co-op Bank’s ethical policy is about businesses and governments, not individual customers, the Co-op is committed to turn away groups that “advocate discrimination and incitement to hatred”. This has led to its declining bank accounts to organisations because of their extreme views, as in the case of Christian Voice. The bank also rules out finance to any company that “supplies arms to oppressive regimes”. In practice this rules out finance for the defence sector, as arms companies are not known for avoiding oppressive states as clients.

As a Customer Union of ethically-motivated Co-op Bank customers, this ethical approach, which is based on a strong mandate from customers, is a big part of why we stick with the bank and work to hold it to account. It’s for the same reason that we’ve criticised decisions by the bank to close accounts of Palestinian solidarity campaign groups as part of a badly-implemented de-risking exercise.

The way parts of the media are framing bank decisions around both Farage and the arms industry as unfair “discrimination” is worrying. In both cases, we have powerful figures being portrayed as victims, when no responsible bank should be supporting the sale of arms to oppressive regimes, and when Nigel Farage has the same right to a basic bank account as anyone else.

And as customers of the Co-op Bank, we have a right to have a say about where our money goes. It is legitimate for us as bank customers to be able to choose not to support the arms industry, or for that matter the fossil fuel industry, which is fuelling the deadly heatwaves that should be occupying newspaper front pages instead of fake outrage about Farage’s finances.

Together we can make sure the Co-op Bank’s ethical approach continues to pave the way, and is taken up by more of the mainstream banking industry. Nigel Farage, this time with tales of banking woes, once again hogs the headlines. But whilst he’ll soon be yesterday’s news, the Customer Union for Ethical Banking is here to stay, working to champion ethical banking. You can bank on that.

info@saveourbank.coop

info@saveourbank.coop @SaveOurBank

@SaveOurBank @saveourbank

@saveourbank