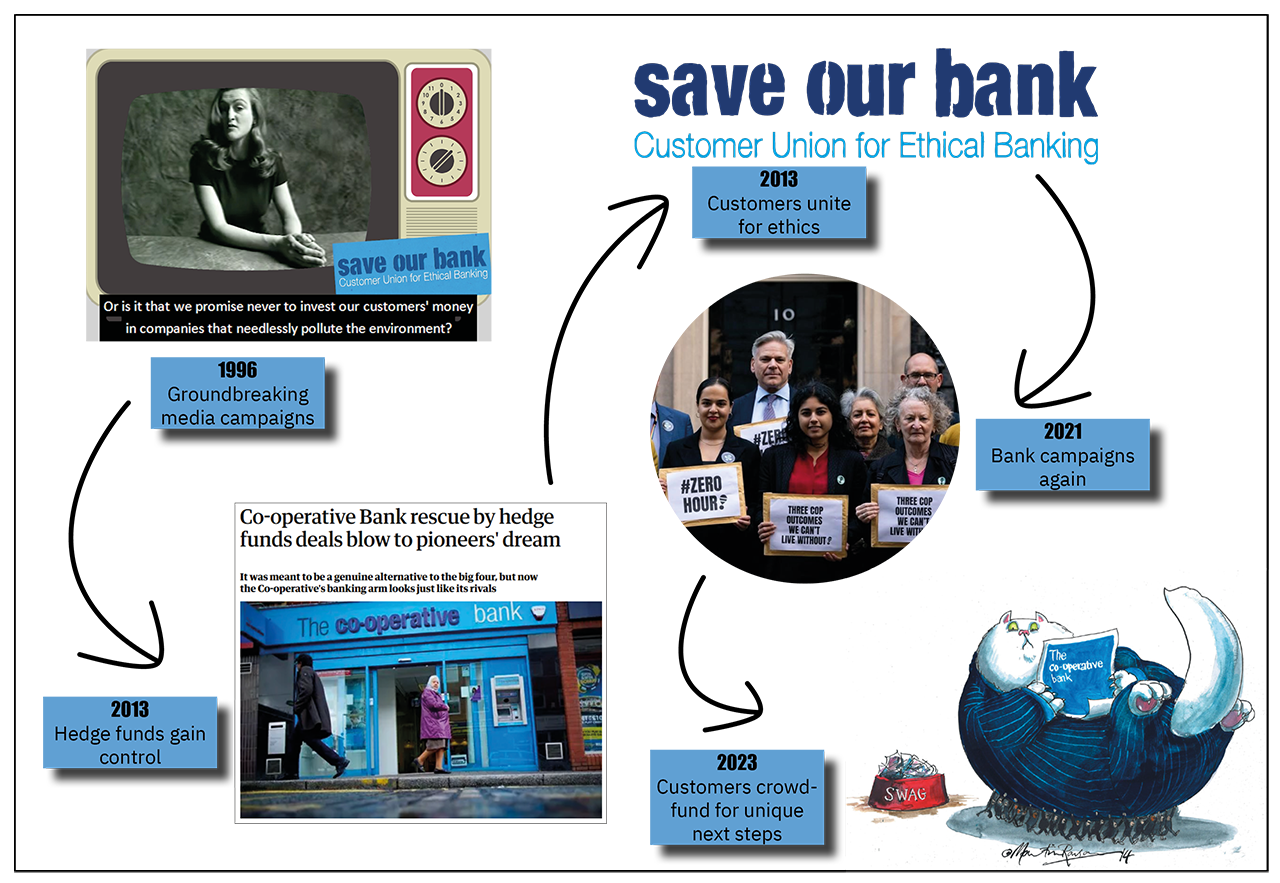

Welcome to this March newsletter from the Customer Union for Ethical Banking, the independent union for customers of The Co-operative Bank.

In this month’s newsletter we have an update on our crowdfunder and some other news from the bank.

Our crowdfunder is already 50% of the way there!

Firstly, a big thank you to those of you who already donated to our crowdfunding campaign to support the next decade of the Customer Union, which we launched in our last newsletter just three weeks ago. We set out to raise £18,000 to put our plans into action. Three weeks on, we’re up to £9,690 - already over half way there!

This means we’ve already raised enough to deliver phase one of our plan: moving forward with our ownership project. This means we can start doing the detailed research and development on how we create a fund to collectively acquire at least some shares in the Co-op Bank. It also means we just need to raise another £2,990 before we can move ahead with the second part of our plan, to grow the Customer Union.

This means we’ve already raised enough to deliver phase one of our plan: moving forward with our ownership project. This means we can start doing the detailed research and development on how we create a fund to collectively acquire at least some shares in the Co-op Bank. It also means we just need to raise another £2,990 before we can move ahead with the second part of our plan, to grow the Customer Union.

This is a great result, and we’re bowled over by your generosity and support. But of course we still have quite a way to go, and we’ve got more of a chance of getting there if we can keep the momentum building. So if you haven’t donated yet, please do take a look at the crowdfunding page, and support us if you’re able to.

If for any reason you prefer to donate outside of the FundRazr platform, you can also:

- Make a donation at our site here - this gives you an option to pay by cheque or bank transfer as well as PayPal, credit and debit card.

- Or just send a cheque in the post to Customer Union for Ethical Banking, Unit 21, 41 Old Birley Street, Manchester M15 5RF

- Or if you'd prefer to make a direct bank transfer, just reply to this email and we'll send you our bank account details

Meeting with the Co-op Bank

We held our quarterly meeting with the Co-operative Bank at the end of January, and met the bank’s new Chief People and Sustainability Officer, Catherine Douglas, for the first time. We raised several matters that our members have contacted us about, including asking the bank to allow not-for-profit organisations that are registered as “companies limited by guarantee” to access free banking. Registered charities, community interest companies and cooperatives have long been able to bank for freeat the Co-op. But companies limited by guarantee cannot, although most companies set up this way are not-for-profit. We also continue to urge the bank to set out clearly how it will respond to the All-Party Parliamentary Group on Mortgage Prisoners’ recommendations to the bank.

We held our quarterly meeting with the Co-operative Bank at the end of January, and met the bank’s new Chief People and Sustainability Officer, Catherine Douglas, for the first time. We raised several matters that our members have contacted us about, including asking the bank to allow not-for-profit organisations that are registered as “companies limited by guarantee” to access free banking. Registered charities, community interest companies and cooperatives have long been able to bank for freeat the Co-op. But companies limited by guarantee cannot, although most companies set up this way are not-for-profit. We also continue to urge the bank to set out clearly how it will respond to the All-Party Parliamentary Group on Mortgage Prisoners’ recommendations to the bank.

Also at the meeting we heard about what was coming up in the bank’s new Sustainability Report, which was released a few days ago. One headline is that the bank has set a new target to reduce its emissions to “net zero” on scope 1 and 2 by 2030, and scope 3 by 2050 at the latest. You can review the report here, and we’ll bring you our summary in next month’s newsletter, including how this new commitment measures up against other UK banks.

Also at the meeting we heard about what was coming up in the bank’s new Sustainability Report, which was released a few days ago. One headline is that the bank has set a new target to reduce its emissions to “net zero” on scope 1 and 2 by 2030, and scope 3 by 2050 at the latest. You can review the report here, and we’ll bring you our summary in next month’s newsletter, including how this new commitment measures up against other UK banks.

Co-op reportedly bidding for Sainsbury’s mortgage book

Sky News once again has a scoop from an “insider” on goings-on at the Co-op Bank. This month we learned that the bank has (allegedly) tabled an offer for a £650m loan portfolio that Sainsbury’s Bank is looking to sell, and “appeared to be the frontrunner in the process”. It would be great to see the Co-op Bank expand, as long as it avoids the mistakes of the past.

Sky News once again has a scoop from an “insider” on goings-on at the Co-op Bank. This month we learned that the bank has (allegedly) tabled an offer for a £650m loan portfolio that Sainsbury’s Bank is looking to sell, and “appeared to be the frontrunner in the process”. It would be great to see the Co-op Bank expand, as long as it avoids the mistakes of the past.

The news came shortly before the bank announced increased profits, up to £132.6 million from £31.1m a year before, which seems well and truly to put the bank’s decade of loss-making behind it.

That’s all from us for this month. We hope you’ll excuse us one more mention of the crowd-fund before we sign off - please do consider contributing if you can, and also sharing on social media, or by forwarding on this email.

Thank you for reading and following the work of the Customer Union.

With best wishes,

The Save Our Bank team

Have you joined the Customer Union yet? It costs £15 a year to be a member of the first ever customer union co-operative, and help us ensure the Co-op Bank sticks to its principles. It only takes a few moments to sign up here.

info@saveourbank.coop

info@saveourbank.coop @SaveOurBank

@SaveOurBank @saveourbank

@saveourbank